Investglass is a Swiss company offering a full sales automation solution to bankers and investment managers.

Z Digital Agency manager, Timothee Bardet, wanted to interview Alexandre Gaillard, CEO of Investglass, because this FinTech company is leading the massive scale change happening in the banking industry: sales automation, personalization and a shift in the value-added.

Sales are getting automated thanks to a much higher technology acceptance rate. Four years ago most bankers were telling me: “I will never use a sales automation system”.

Now 200 users and 40 companies later, bankers and investment managers are saying: “I cannot stand doing low value-added tasks anymore”.

The market has changed:

- For bankers who are leaving because banks are getting older and slower, to open their own family offices.

- For investment managers because discretionary management is getting handled by robot advisors

- For the investment management market, getting more and more fragmented and regulated, impacting heavily its cost structure

The question has become: Where is your new value-added?

The knowledge economy has become outdated. Providing market information to fully connected clients brings no value-added. The new paradigm is an individualized experience. What was a paid service 10 years ago is now free. Today’s paid services will be also free tomorrow. The bankers who will not adapt will have to increase their management fees and invent new value-added services to their clients.

The current biggest challenge for investment managers: how to serve a client with CHF 50K and a client with CHF 50M with a tailored value added? The answer requires a “mass individualization automation”, an oxymoron that reveals the needs for technology solutions.

What is the differentiation strategy of Investglass compared with existing CRM/Client Portal solutions ?

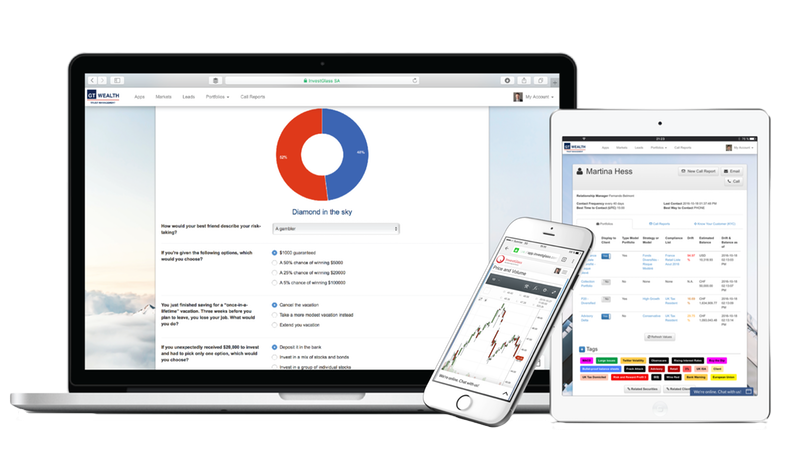

The alternative solutions to manage a large client portfolio are Salesforce or other CRM, requiring heavy customization to fit the client workflow in this industry. Investglass is a ready-to-use CRM solution, providing a complete automation (content, client portal and AI-based investment persona) for all clients of an investment manager.

What is the use of Artificial Intelligence made by Investglass?

- Investglass uses structured algorithms to link declarative data, peer correlation and asset classes, automating the sales manager former work in a tool, in a transparent way. “I can draw the algorithm if a client asks me”, told us Alexandre Gaillard.

- Investglass uses non-structured algorithms on clients data to bring a complete picture of the client to the investment manager, learning for instance to spot a client investing outside of the asset class he declared initially, to better serve that client with the relevant contents and proposals.

What are the 2 biggest challenges for Investglass right now?

- The positioning: Investglass is an end-to-end service, sometimes complex to position in the market. Indeed this hybrid and tailored service for investment sales managers includes an AI, a CRM, a CMS and a Client Portal. A recurring challenge in the world of Fintech which often merges client cycles into one workflow.

- Sales: gain market shares in Europe. The market is getting evangelized right now. Even if managers are aware of the changes happening, Investglass is still a small Swiss company, which requires a face to face approach to convince investment managers.

A digital strategy will be activated in the future, using the key assets of this Fintech: its clients (investment managers who gained time and brought value added to their portfolio clients) and its team.